Downloads of this chart in .xlsx are available in professional view.

Professional view costs €89.90 for one year.

Professional view does not renew automatically.

Get professional view or log in.

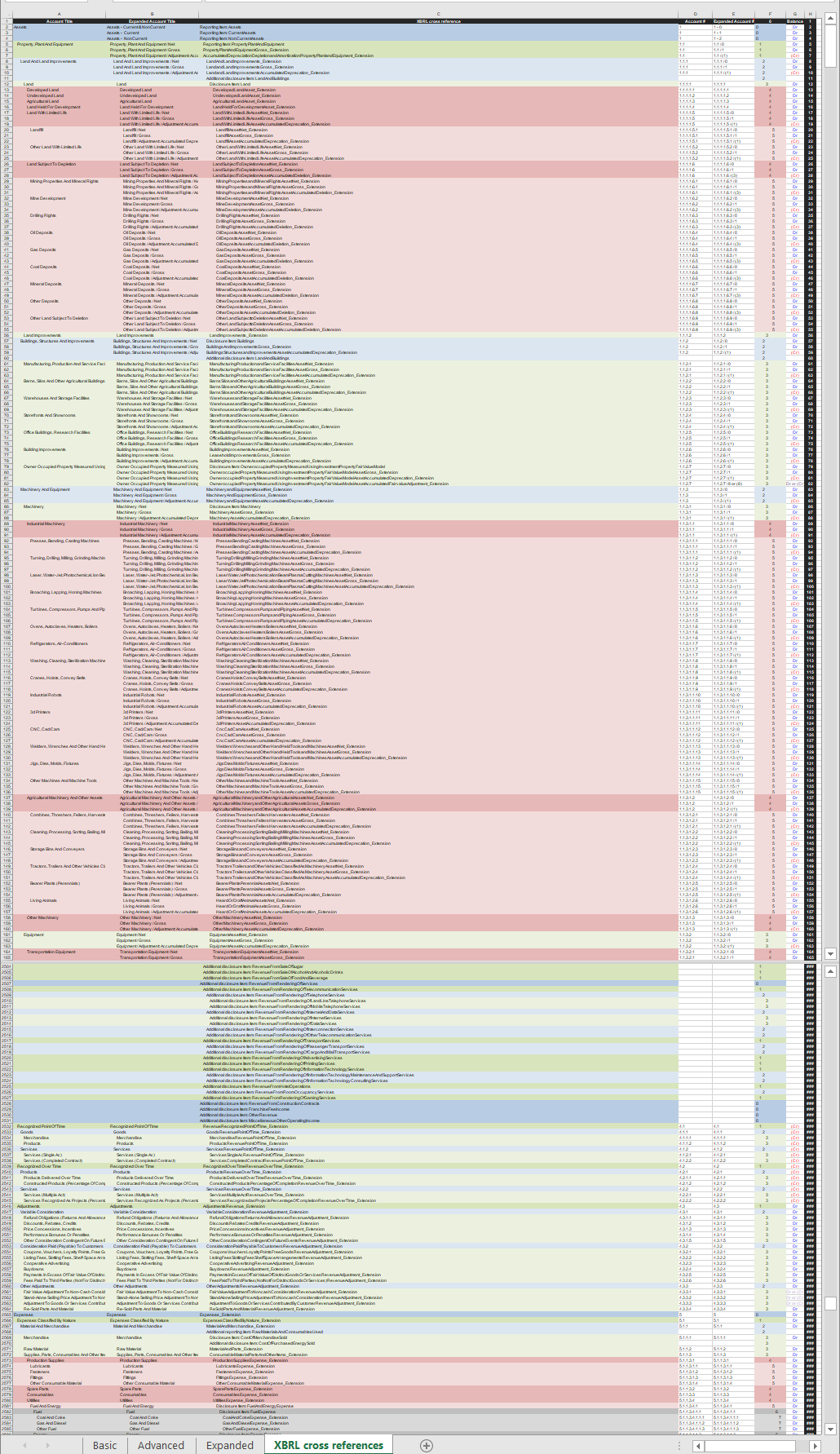

This chart of accounts includes basic IFRS-compatible classifications and sub-classifications and XBRL cross-references.

The IASB does not publish an "IFRS chart of accounts."

Companies may use any chart of accounts, provided it is consistent with published recognition guidance (link: eifrs.ifrs.org).

This chart has been designed to be consistent with this guidance.

While users may delete unnecessary / add additional sub-accounts, they are advised to keep its general structure intact.

eXtensible Business Reporting Language is a reporting language.

"In a nutshell, XBRL provides a language in which reporting terms can be authoritatively defined. Those terms can then be used to uniquely represent the contents of financial statements or other kinds of compliance, performance and business reports. XBRL lets reporting information move between organisations rapidly, accurately and digitally" (link: xbrl.org).

It is not a chart of accounts.

The chart of accounts presented here includes XBRL cross references to ease the drafting of XBRL tagged financial reports.

Some items necessary for accounting do not have a defined (link: ifrs.org) XBRL counterpart. These items are labled XYZ:.

IFRS XBRL is also viewable online (link: corefiling.com).

For example, a company with petty cash and two bank accounts, would add:

| Account Title | Account # |

| Assets | 1 |

| --- | --- |

| Cash And Cash Equivalents | 1.9 |

| Cash | 1.9.1 |

| Petty cash | 1.9.1.1 |

| Cash in bank | 1.9.1.2 |

| Cash in bank, account one | 1.9.1.2.1 |

| Cash in bank, account two | 1.9.1.2.2 |

| --- | --- |

A company with customers (i.e. customer # 123, customer # 234, customer number # 345), would add:

| Account Title | Account # |

| Assets | 1 |

| --- | --- |

| Receivables | 1.8 |

| Trade Receivables | 1.8.1 |

| Customer 123 | 1.8.1.123 |

| Customer 234 | 1.8.1.234 |

| Customer 345 | 1.8.1.345 |

| --- | --- |

In addition to permanent accounts, temporary accounts for individual receivables (i.e invoice # 00321, invoice # 00332, invoice # 00358), may also be added:

| Account Title | Account # |

| Assets | 1 |

| --- | --- |

| Receivables | 1.8 |

| Trade Receivables | 1.8.1 |

| Customer 123 | 1.8.1.123 |

| Invoice 00321 | 1.8.1.123-00321 |

| Invoice 00321 | 1.8.1.123-00332 |

| Invoice 00321 | 1.8.1.123-00358 |

| --- | --- |

This chart does not make a current/non-current distinction.

As the current / non-current status of an item is a reporting rather than recognition issue, incorporating the current / non-current distinction into the account structure not only adds unnecessary complexity, but can lead to unnecessary item reclassification.

IAS 1.60 An entity shall present current and non-current assets, and current and non-current liabilities, as separate classifications in its statement of financial position in accordance with paragraphs 66–76 except when a presentation based on liquidity provides information that is reliable and more relevant. When that exception applies, an entity shall present all assets and liabilities in order of liquidity.

For example, a company can acquire an available-for-sale financial instrument with the intention of holding it for less than 12 months then, during the holding period, change its intention.

Nevertheless, as some companies prefer a chart of accounts that makes this distinction, a current / non-current chart of accounts is available to subscribers.

This chart includes expenses classified by both nature and function.

IFRS requires nature of expense disclosure, and permits both function and nature of expense reporting.

IAS 1.104 An entity classifying expenses by function shall disclose additional information on the nature of expenses, including depreciation and amortisation expense and employee benefits expense.

IAS 1.99 An entity shall present an analysis of expenses recognised in profit or loss using a classification based on either their nature or their function within the entity, whichever provides information that is reliable and more relevant.

From an accounting perspective, a nature based account structure yields superior operational results.

For a more detailed example see: Nature of expense, function of expense.

For example, if accounts were organized by function, the result will resemble:

| --- | --- |

| Expenses Classified By Function | 5.2 |

| Cost Of Sales | 5.2.1 |

| Emloyee benefits | 5.2.1.1 |

| Wages | 5.2.1.1.1 |

| Salaries | 5.2.1.1.2 |

| --- | --- |

| Selling, General And Administrative | 5.2.2 |

| Emloyee benefits | 5.2.2.1 |

| Wages | 5.2.2.1.1 |

| Salaries | 5.2.2.1.2 |

| Commissions | 5.2.2.1.3 |

| --- | --- |

When accounts are initially organized by nature, the result can resemble:

| Account | Department | ||

| --- | --- | --- | |

| Expenses Classified By Nature | 5.1 | ||

| Employee Benefits | 5.1.3 | ||

| Production department | 5.1.3 | - | 5.2.1 |

| Sales department | 5.1.3 | - | 5.2.2.1 |

| Administrative department | 5.1.3 | - | 5.2.2.2 |

| --- | --- |

Also note, while it would be possible to add a digit for country of domicile, subsidiary, segment, reporting unit etc., in practice it is more practical for each such entity to maintain separate accounts, which are then consolidated:

| Country | Account | Department | |||

| --- | --- | ||||

| Employee Benefits - UK | 1 | - | 5.1.3 | ||

| Production department - UK | 1 | - | 5.1.3 | - | 5.2.1 |

| Sales department - UK | 1 | - | 5.1.3 | - | 5.2.2.1 |

| Administrative department - UK | 1 | - | 5.1.3 | - | 5.2.2.2 |

| --- | --- | ||||

| Employee Benefits - France | 2 | - | 5.1.3 | ||

| Production department - France | 2 | - | 5.1.3 | - | 5.2.1 |

| Sales department - France | 2 | - | 5.1.3 | - | 5.2.2.1 |

| Administrative department - France | 2 | - | 5.1.3 | - | 5.2.2.2 |

| --- | --- |

Updated to reflect the 2025 ITI illustrating the application of IAS 1.

The this COA cross references the ITI illustrating the application of IAS 1 Presentation of Financial Statements (link: ifrs.org).

The ITI illustrating the early application of IFRS 18 Presentation and Disclosure in Financial Statements combines the previous, IAS 1 presentation of nature of expense / function of expense separately into a single statement format.

Mapping expense accounts into this single statement format would result in double counting.

For example the CostOfSales documentation states (emphasis added): The amount of all expenses directly or indirectly attributed to the goods or services sold, in the operating category in the statement of profit or loss. Attributed expenses include, but are not limited to, costs previously included in the measurement of inventory that has now been sold, such as depreciation and maintenance of factory buildings and equipment used in the production process, unallocated production overheads, and abnormal amounts of production costs of inventories.

The DepreciationExpense documentation states: The amount of depreciation expense, in the operating category in the statement of profit or loss. Depreciation is the systematic allocation of depreciable amounts of tangible assets over their useful lives.

The EmployeeBenefitsExpense documentation states: The amount of all expenses directly or indirectly attributed to the goods or services sold, in the operating category in the statement of profit or loss. Attributed expenses include, but are not limited to, costs previously included in the measurement of inventory that has now been sold, such as depreciation and maintenance of factory buildings and equipment used in the production process, unallocated production overheads, and abnormal amounts of production costs of inventories.

The IAS 2.12 (edited, emphasis added) states: The costs of conversion of inventories include costs directly related to the units of production, such as direct labour. They also include a systematic allocation of fixed and variable production overheads that are incurred in converting materials into finished goods. Fixed production overheads are those indirect costs of production that remain relatively constant regardless of the volume of production, such as depreciation and maintenance of factory buildings, equipment and right-of-use assets used in the production process, and the cost of factory management and administration...

As CostOfSales already includes costs directly or indirectly attributed to the goods or services sold such as direct labour and depreciation of, for example, factory buildings, equipment and right-of-use assets, presenting these costs again in DepreciationExpense and EmployeeBenefitsExpense would result in their being double counted.

As IFRS 18 is not mandatory until 2027, it is likely this issue will be addressed before it becomes mandatory. In the meantime, this COA will continue to with cross references to IAS 1's, two statement format.

Subscriber.xlsx