The standardized chart of accounts is suitable for both IFRS and US GAAP as well as other, comparable accounting standards. It is available in various versions, from basic to expert.

On the one hand, IFRS (link) and US GAAP (link) guidance takes a presentation-focused approach, emphasizing faithful financial statement reporting and disclosure over rigidly defined accounting mechanics.

On the other hand, while the guidance does give entities considerable leeway with respect to recognition and measurement, IFRS | US GAAP financial reports, particularly machine-readable, XBRL-tagged reports, are surprisingly uniform.

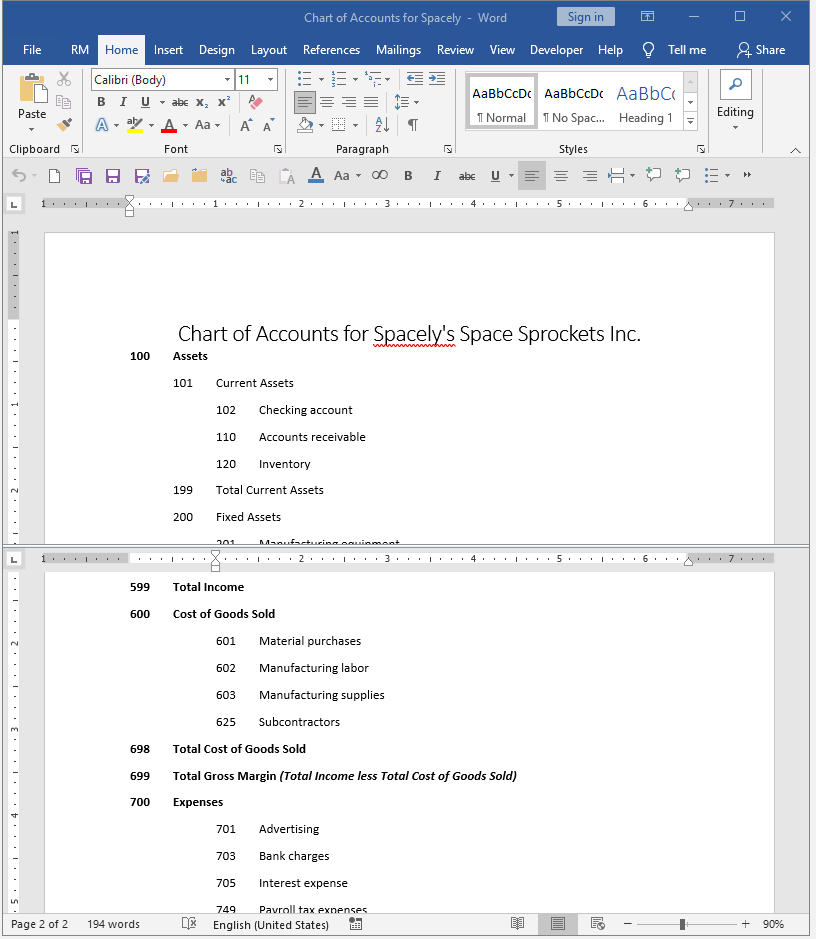

One of the most effective ways to ensure both operational flexibility and reporting consistency is a well-designed chart of accounts. Unfortunately, the nature of IFRS and US GAAP prevent the IASB and FASB from defining, or even discussing, a standard chart of accounts.

Since designing a chart of accounts that balances a business's need for internal flexibility against external reporting conformity is surprisingly difficult, this page has been offering readymade COAs since 2010.

The main source of difficulty seems to be tradition.

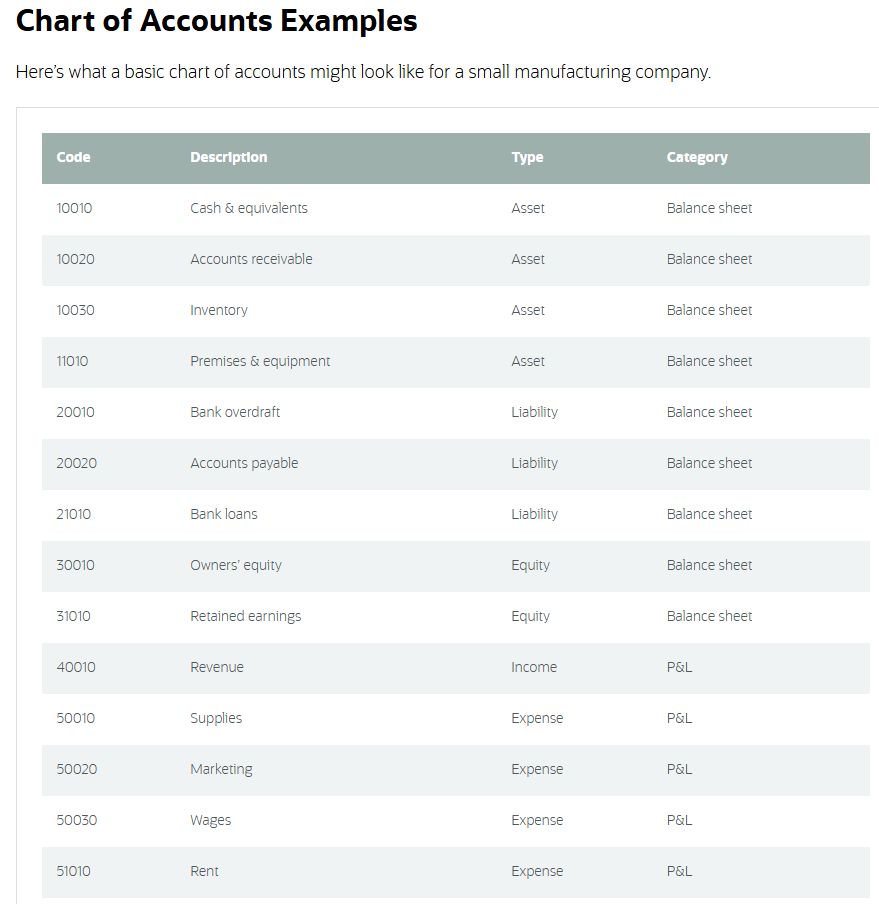

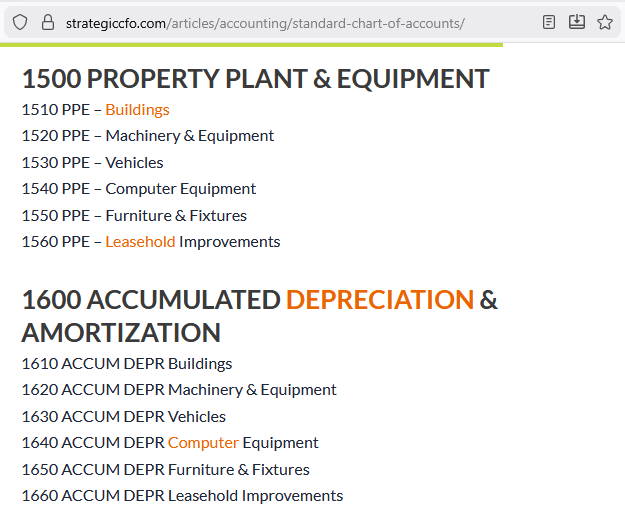

For example, in COAs such as this, the acocunt numbering scheme means that, for example, Machinery & Equipment is limited to 9 items making granularity impossible to achive. It also takes the traditional approach of segregating the item from its associated adjustment requiring two completely separate account classes to keep track of a single asset type (note: PP&E is depreciated not amortized).

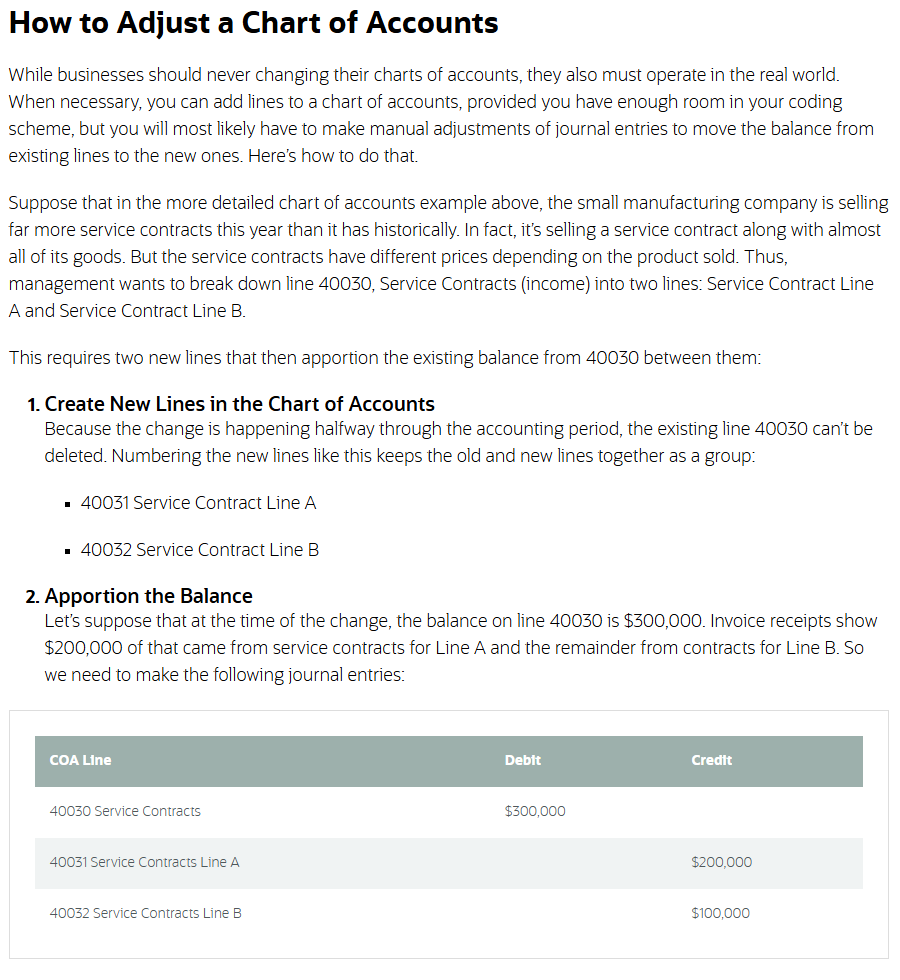

The traditional approach also leads some pages to give seeming contradictory advice. For example, while this page (link) correctly points out "The detail put into a chart of accounts sets the ceiling for financial analysis. If the chart of accounts doesn’t capture a data point, it won’t make it into any report" and "A well-structured chart of accounts also supports accurate, compliant financial statements. Misclassified accounts can distort key metrics and trigger audits, especially for businesses following Generally Accepted Accounting Principles (GAAP)" it suggests "A chart of accounts can become unnecessarily complex if it contains too many categories and subcategories" and recomends "If a chart of accounts has more than three levels, consider setting up subledgers."

However, allowing the staff to add additional items to subledgers on an ad hoc basis does nothing to address the fundamental problem which, as the page also points out, happens when "Inconsistent naming and coding can cause staff to interpret accounts in different, unintended ways. This inconsistency creates reconciliation problems, reporting gaps, and trouble rolling up results across departments or entities." Perhaps, if the page considered the problem is not the detail, but the way the detail is organized, it may have reached a different conclusion.

Why vague COAs and ad hoc subledgers are so dangerous.

A frequently repeated recommendation is to keep the chart of accounts as simple and high-level as possible, and to “push detail” into subledgers or dimensions when needed. In theory, this keeps the general ledger tidy. In practice, especially in international groups, it often produces the opposite of what good accounting requires: inconsistency, inaccuracy, and loss of control.

The problem is structural. If the COA is overly general and staff are allowed to create subledgers ad hoc, the system as a whole becomes fragmented. Each accountant, department, or subsidiary can develop its own unofficial structure under the same top-level accounts. Over time, what appears to be a single, consistent account in group reporting actually represents a patchwork of different local practices and interpretations.

This is particularly acute in cross-border groups. Consider a US parent that gives its foreign subsidiary a rudimentary US GAAP reporting package with a handful of broad lines to fill out. The subsidiary completes the package to keep the parent satisfied, even when the mapping from local GAAP to those broad US GAAP categories is approximate at best. If local staff are also free to “solve” gaps by building their own subledgers and coding schemes, the risk is that the reported numbers look acceptable on the surface, but are structurally wrong underneath.

The less familiar local staff are with IFRS or US GAAP, the greater this risk becomes. Giving them wide latitude to modify the underlying structure through subledgers and custom codes is effectively delegating COA design to the people least equipped to do it. The very issues many experts warn about—“inconsistent naming and coding” causing reconciliation problems, reporting gaps, and trouble rolling up results across departments or entities—are made worse, not better, by vague COAs plus ungoverned subledgers.

A detailed, well-designed chart of accounts is the opposite of unnecessary complexity. It is a control instrument. By defining accounts precisely and structuring them carefully, the entity reduces the scope for arbitrary local interpretation, makes mappings from local GAAP to IFRS | US GAAP repeatable and auditable, and limits the need for improvised substructures that nobody fully understands. In this context, “detail” is not a problem to be hidden in subledgers; it is the means by which the entity protects itself against quiet, systemic misclassification in its financial reporting.

Note: while both of the above at least make an effort, one may, occasionally, encounters pages that do not.

While it correctly warns that the wrong chart of accounts will destroy a business before it even starts, it then publishes a sample that will likely yield this exact result.

That the site charged $49.90 for this COA illustrates that, particularly on the internet, caveat emptor is a golden rule.

Note: the site has since retracted the article. It continues to be shown here for the sake of posterity.

While generally comparable, IFRS and US GAAP do not provide identical guidance.

Thus, while this Standardized COA may be used for dual reporting purposes, adjustments will be necessary. Adjustments will also need to be made if, for example, a US GAAP parent consolidates its IFRS subsidiary or vice versa.

The Illustrations section outlines most common differences between IFRS and US GAAP.

We strongly recommend reviewing the Illustrations section thoroughly before attempting to use the Standardized COA for dual reporting and/or consolidation purposes.

IFRS and US GAAP approach accounting with a report driven focus, emphasizing recognition, measurement and financial statement presentation based on judgment. As such, neither prescribes bookkeeping procedures or a standard chart of accounts.

By contrast, a number of EU member states (e.g. France, Belgium, Germany, Luxembourg or the Czech Republic) implement the EU Accounting Directive through a national GAAP taking procedural perspective defining, for example, a required COA. Internationally, such rigid accounting may also be found in, for example. Russia or OHADA member states. Some jurisdictions, such as Nigeria, use a blend requiring fixed COAs for non-private entities while offering privately owned entities more flexibility.

For example, Czech accounting standards (link: businesscenter) state this about recognizing revenue (CAS 19. 4.2): "the sale of products and merchandise is, on the basis of relevant documents (such as invoices), credited to the relevant account in account group 60 - Revenue with the corresponding debit made to the relevant account in account group 31 - Receivables (short and long-term) or account group 21 - Cash."

Similarly, the French (link: anc.gouv.fr) accounting standard Art. 947-70 (view pdf) states: "… Les montants des ventes, des prestations de services, des produits afférents aux activités annexes sont enregistrés au crédit des comptes 701 "Ventes de produits finis", 702 "Ventes de produits intermédiaires", 703 "Ventes de produits résiduels", 704 "Travaux", 705 "Études", 706 "Prestations de services", 707 "Ventes de marchandises" et 708 "Produits des activités annexes"."

This guidance obviously assumes a fixed and defined COA every accounting entity is obligated to apply.

Before mapping this COA to a national COA please conform the process would conflict with national legislation.

For example, in the Czech Republic, the Accounting Act 563/1991 paragraph §19a (1) states:

"An [unconsolidated] entity that is a trading company and is an issuer of investment securities admitted to trading on a European regulated market shall apply international accounting standards regulated by European Union law (hereinafter referred to as "international accounting standards") for accounting and the preparation of financial statements" [paragraph § 23a requires IFRS at the consolidated entity level].

This implies, if the COA presented here is used for IFRS bookkeeping purposes and IFRS recognition guidance is applied correctly, it may (implicitly) be used in place of the chart of accounts mandated by the same law but only by a trading company (consolidated entity) that is an issuer of investment securities admitted to trading on a European regulated market.

Nevertheless, the Income Tax Act 586/1992 §23 (2) states:

"The tax base is determined a) from the net income (profit or loss), always without the influence of International Accounting Standards, for taxpayers required to maintain accounts. A taxpayer that prepares financial statements in accordance with International Accounting Standards regulated by European Community shall apply for the purposes of this Act to determine net income and to determine other data decisive for determining the tax base a special legal regulation [CZ GAAP]). When determining the tax base, entries in off-balance sheet account books are not taken into account, unless otherwise provided in this Act. ..."

Thus, since Czech accounting law assumes the mandated chart of accounts will be used for accounting purposes, if a different chart of accounts is used, it will need to yield the same result as if the mandated chart or accounts were used. While this is not impossible with careful mapping and associated adjustments, it is generally more practical to use the mandated national GAAP COA for local accounting/taxation purposes and a separate COA for IFRS reporting and disclosure purposes.

The basic version would be sufficient for a small business and is available free of charge. The advanced versions are scalable and may be used by businesses of any size or complexity.

As a general rule, only publicly traded entities have a formal obligation to apply IFRS or US GAAP guidance. As such, their accounting system must be robust enough to fulfill the extensive recognition and measurement guidance outlined in these standards.

Non-public entities in jurisdictions that do not mandate accounting practices have more flexibility and may elect to use any structure they choose. Nevertheless, a sound account structure will help any business, regardless of size, optimize its operational efficiency and fuel data-driven decision-making. Equally important, it allows the entity to fulfill the tax reporting obligation shared by all entities, regardless of size or ownership structure.

Since the IFRS SME standards | ASC non-public entity guidance is the backbone of accounting for all entities, COAs that reflect this guidance are useful to all but the smallest businesses.

Businesses whose accounting consists of tracking cash flow so they can report income to a tax authority have no need for a COA or any formal accounting system. Their accounting needs can be met by simply downloading a bank statement and adding up all their cash receipts and disbursements.

As anyone who has ever started a business knows, starting a business is the easy part. Keeping it running smoothly and profitably is where the real challenge lies. To help those just starting out, this site publishes workable, basic COAs, that can be expanded as needed, free of charge. After all, every business that survives the startup phase makes the business community richer and more diverse so is in everyone's best interest.

Its advanced version is suitable for a single large entity as well as a group of entities. Its expanded version is designed for entities facing complex tasks such as accounting for various financial instruments or consolidating subsidiaries operating in foreign jurisdictions, particularly where they are also subject to non‑IFRS or non‑US GAAP accounting and/or reporting requirements. For publicly traded entities, its XBRL cross‑referenced version is designed to assist in drafting the machine‑readable financial reports required by some regulators.

The COA is Standardized only as far as guidance is concerned. It is compatible with IFRS, US GAAP, UK GAAP, Aus GAAP and other comparable standards.

It is not entity Standardized. Instead, it is intended to be adjusted to fit the specific structure of any particular entity.

To make this as simple as possible, the COA is designed to be dynamic and easily modifiable. Accounts or sub accounts may be added or deleted without the need to manually update fields such as type or parent. This automation removes the manual work required by a static COA, such as the plug and play basic version downloadable on this page.

Guidance on how to implement a dynamic COA is available on this page.

The IFRS and US GAAP COAs are more specialized. The IFRS COA additionally mirrors the structure of IFRS financial reports, which helps streamline the report drafting process. The basic versions of each are also offered free of charge.

IFRS approaches accounting from a reporting-focused perspective, with emphasis on recognition, measurement, and financial statement presentation and disclosure. As such, it does not prescribe bookkeeping procedures or a standard chart of accounts. Entities operating in jurisdictions such as the UK, Canada, Australia, Japan, Korea, China, India, etc. may generally define any COA provided it yields a financial report consistent with IFRS guidance.

Nevertheless, as designing a workable COA is a time consuming and laborious process, many entities prefer to use an off-the-self version particularly if it can be, with minimal effort, adjusted to reflect the entity’s financial structure.

The GAAP used in the US approaches accounting from a reporting-focused perspective, with emphasis on recognition, measurement, and financial statement presentation and disclosure. As such, it does not prescribe bookkeeping procedures or a standard chart of accounts. Entities operating in the United States may define any COA provided it yields a financial report consistent with GAAP guidance.

Nevertheless, as designing a workable COA is a time consuming and laborious process, many entities prefer to use an off-the-shelf version particularly if it can be, with minimal effort, adjusted to reflect the entity’s financial structure.

While only publicly traded entities generally have an obligation to apply IFRS | US GAAP, IFRS (particularly the IFRS SME standard) | US GAAP (particularly the Private Company Council framework) is the backbone of accounting for all entities (except those domiciled in jurisdictions that mandate accounting practice as discussed above.)

Thus, even small, private entities are better off using an account structure consistent with the guidance, particularly if they have ambition to grow and eventually become large, public entities.