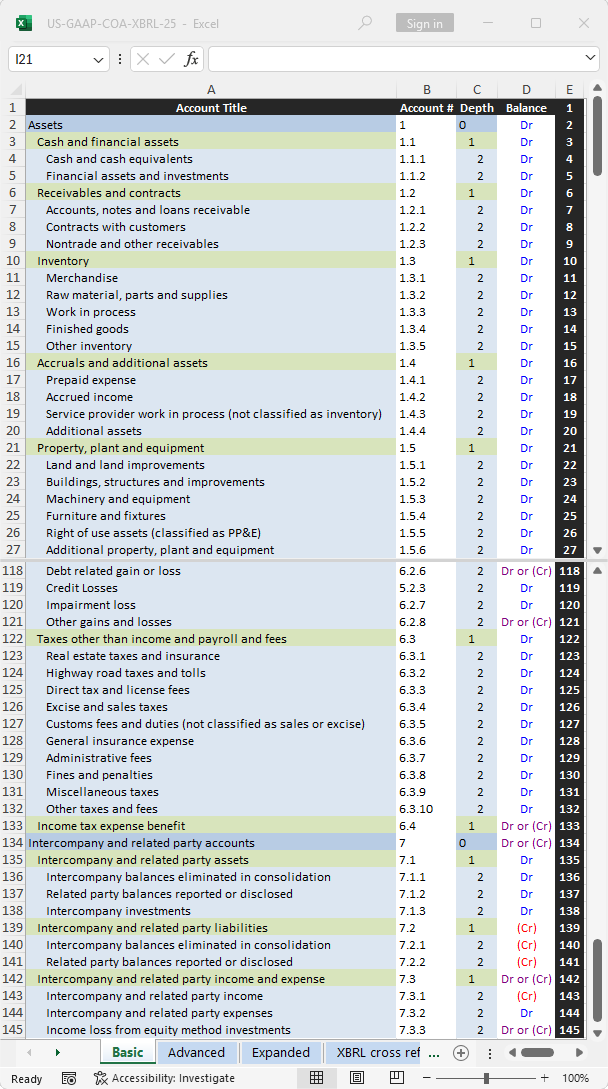

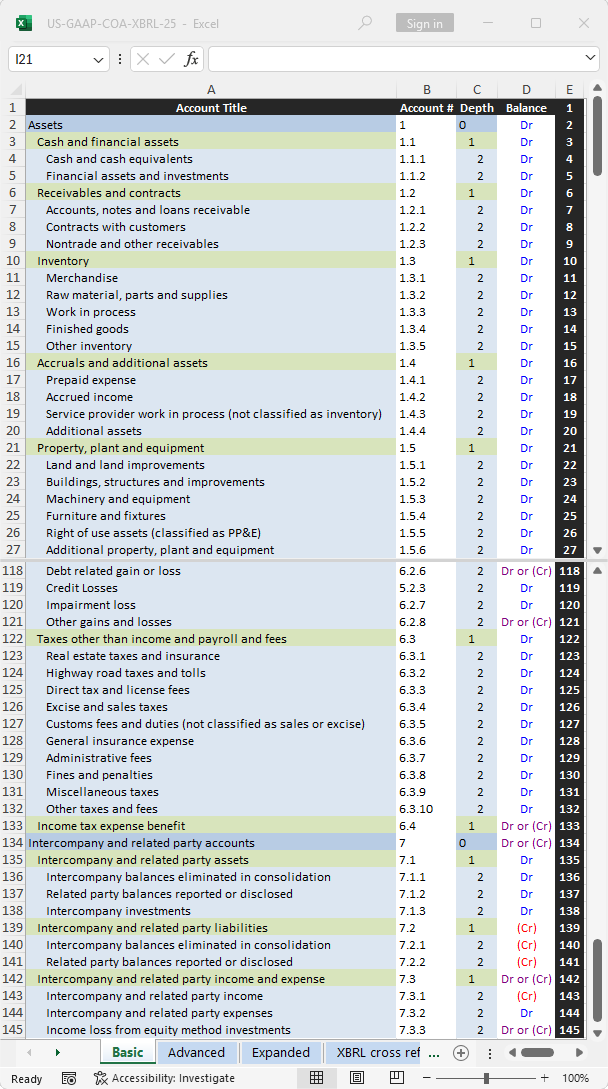

Download the basic GAAP COA in .xlsx.

Professional view costs €89.90 for one year.

Professional view does not renew automatically.

Get professional view or log in.

Additional guidance on how to implement a COA is provided on this page.

Download the basic GAAP COA in .xlsx.

Professional view costs €89.90 for one year.

Professional view does not renew automatically.

Get professional view or log in.

Additional guidance on how to implement a COA is provided on this page.