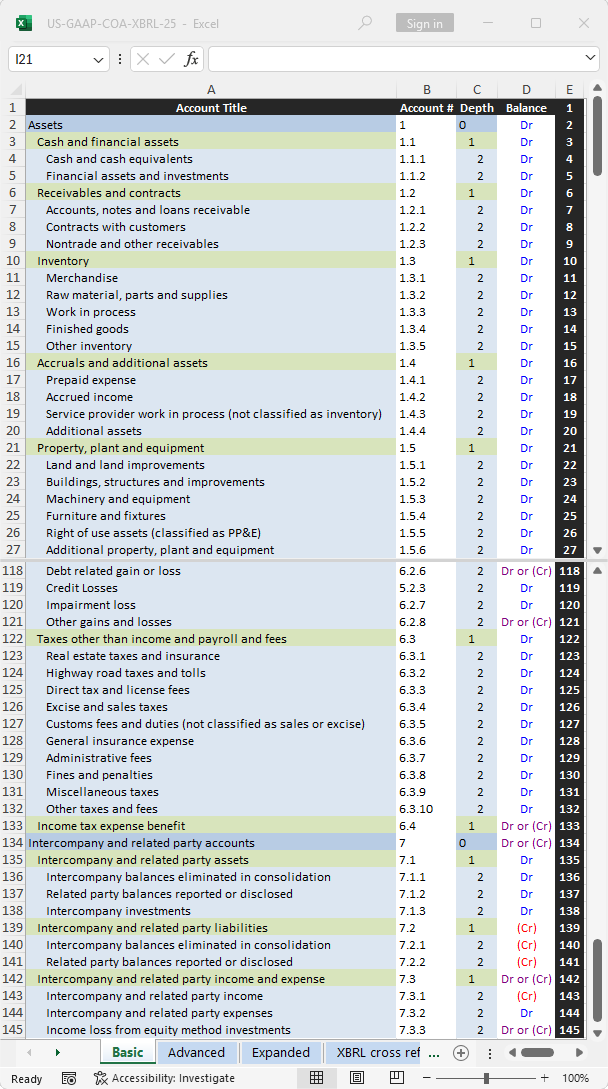

Downloads of the basic chart in .xlsx are available here.

Professional view costs €89.90 for one year.

Professional view does not renew automatically.

Get professional view or log in.

This chart of accounts includes classifications and sub-classifications consistent with US GAAP recognition guidance.

The FASB does not define a US GAAP chart of accounts.

Companies may define any chart of accounts, provided it is consitent US GAAP recognition guidance (link: asc.fasb.org).

The chart of accounts presented on this page has been designed to supoort this reporting guidance.

Its structure can be expanded, but should not be altered.

eXtensible Business Reporting Language is a reporting language.

"In a nutshell, XBRL provides a language in which reporting terms can be authoritatively defined. Those terms can then be used to uniquely represent the contents of financial statements or other kinds of compliance, performance and business reports. XBRL lets reporting information move between organisations rapidly, accurately and digitally" (link: xbrl.org).

It is not a chart of accounts.

The chart of accounts presented here includes XBRL cross references to ease the drafting of XBRL taged financial reports.

Some items necessary for accounting do not have a defined (link: xbrlview.fasb.org) XBRL counterpart. These items are labled "_Extension" and presented in a different color to avoid confusion.

For example, a company with petty cash and two bank accounts, it would add accounts:

| Assets | 1 |

| Cash And Investments | 1.1 |

| Cash And Cash Equivalents | 1.1.1 |

| Petty Cash | 1.1.1.1 |

| Cash in bank | 1.1.1.2 |

| Cash in bank, account one | 1.1.1.2.1 |

| Cash in bank, account two | 1.1.1.2.2 |

| --- | --- |

A company that maintains separate accounts for individual customers (i.e. customer # 123, customer # 234, customer number # 345), would add (pernanent) accounts:

| Assets | 1 |

| --- | --- |

| Receivables | 1.2 |

| Accounts, Notes And Loans |

1.2.1 |

| Accounts receivable | 1.2.1.1 |

| Customer 123 | 1.2.1.1.123 |

| Customer 234 | 1.2.1.1.234 |

| Customer 345 | 1.2.1.1.345 |

| --- | --- |

A company that maintains separate accounts for individual receivables

(i.e invoice # 00321, invoice # 00332, invoice # 00358), would add temporary

accounts:

| Assets | 1 |

| --- | --- |

| Receivables | 1.2 |

| Accounts, Notes And Loans |

1.2.1 |

| Accounts receivable | 1.2.1.1 |

| Customer 123 | 1.2.1.1.123 |

| Invoice 00321 | 1.2.1.1.123-00321 |

| Invoice 00321 | 1.2.1.1.123-00332 |

| Invoice 00321 | 1.2.1.1.123-00358 |

| --- | --- |

This chart does not make a current/non-current distinction.

Whether an item is current or non-current is a disclosure rather than recognition issue.

While this distinction can often be made at the time of initial recognition, in some cases it can only be made subsequently.

For example, a company can acquire an available-for-sale financial instrument that it may hold for more or less than 12 months depending on its future liquidity needs.

Incorporating the current/non-current distinction into the accounts would not only reclassifications whenever the situations changed, but would introduce unnecessary complexity into the account structure.

Nevertheless, some companies do prefer using a chart of accounts that makes the current/non-current distinction.

For this reason, a current/non-current chart of accounts is available for download in the subscriber section.

This chart includes expenses classified by both nature and function.

Unlike IFRS, US GAAP does not permit nature of expense income statement reporting. However, ASU 204-03 (ASC 220-40-50-6) updated disclosure guidance to include nature of expense items in the footnotes.

From chart of accounts perspective, it is also far easier to organize accounts nature than by function.

For a more detailed example see: Nature of expense, function of expense.

For example, to recognize expenses by function, the account structure would need, for example, to be:

| Expenses Classified By Function | 5.1 | |

| Cost Of Revenue | 5.1.1 | |

| Cost Of Goods Sold | 5.1.1.1 | |

| Emloyee benefits (wages and salaries) | 5.1.1.1.1 | |

| Wages | 5.1.1.1.1.1 | |

| Salaries | 5.1.1.1.1.2 | |

| etc. | ||

| Cost Of Services Rendered | 5.1.1.2 | |

| Emloyee benefits (wages and salaries) | 5.1.1.2.1 | |

| Wages | 5.1.1.2.1.1 | |

| Salaries | 5.1.1.2.1.2 | |

| etc. | ||

| Selling, General, Administrative | 5.1.2 | |

| Selling and Marketing | 5.1.2.1 | |

| Emloyee benefits (wages and salaries) | 5.1.2.1.1 | |

| Salaries | 5.1.2.1.1.2 | |

| Commissions | 5.1.2.1.1.3 | |

| etc. |

Not a particularly practical way to organize accounts.

The better option to define accounts by nature and capture the function of each expense on a second, department or unit level.

| Account | Department | |

| Expenses Classified By Nature | 5.2 | |

| Employee Benefits | 5.2.2 | |

| Production department | 5.2.2 | 5.1.1.1 |

| Service department | 5.2.2 | 5.1.1.2 |

| Sales department | 5.2.2 | 5.1.2.1 |

| Administrative department | 5.2.2 | 5.1.2.2 |

Update: Februaty 2025.

Subscriber.xlsx