One of the more common questions we get: why use delimited account numbers?

While it is not strictly necessary, most accountants like numbers.

| Assets | 1 |

| Cash And Financial Assets | 1.1 |

| Cash And Cash Equivalents | 1.1.1 |

| Petty Cash | 1.1.1.1 |

| Cash in bank | 1.1.1.2 |

| Cash in bank, account one | 1.1.1.2.1 |

| Cash in bank, account two | 1.1.1.2.2 |

| --- | --- |

A company could use letters:

| Assets | A |

| Cash And Financial Assets | A.F |

| Cash And Cash Equivalents | A.F.C |

| Petty Cash | A.F.C.P |

| Cash in bank | A.F.C.B |

| Cash in bank, account one | A.F.C.B.O |

| Cash in bank, account two | A.F.C.B.T |

| --- | --- |

Any scheme that facilitates machine readability (i.e. XBRL concept names) would, from a technical perspective, be permissible.

However, to put it plainly, most accountants consider anything but numbers really, really weird.

Wouldn't a simple number, without punctuation lead to better results?

The answer is: no, it would not.

Once upon a time, one of our clients had an IT department that, for some reason, could not deal with delimitation.

Since he wanted to keep his programmers happy, he decided to eliminate the period turning this into this.

|

Cash And Financial Assets |

1.1 |

|

Cash and Cash Equivalents |

1.1.1 |

|

Cash |

1.1.2.1 |

|

Currency On Hand |

1.1.2.1.1 |

|

Petty Cash |

1.1.2.1.1.1 |

|

Cash In Vault |

1.1.2.1.1.2 |

|

Cash In Bank |

1.1.2.1.2 |

|

Cash Equivalents |

1.1.2.2 |

|

Deposits And Securities |

1.1.2.2.1 |

|

Certificates Of Deposit |

1.1.2.2.1.1 |

|

Commercial Paper |

1.1.2.2.1.2 |

|

Credit And Debit Card Receivables |

1.1.2.2.1.3 |

|

Money Market Funds |

1.1.2.2.1.4 |

|

Other Highly liquid Investments and Securities |

1.1.2.2.1.5 |

|

Other Cash Equivalents |

1.1.2.2.2 |

|

Postage Stamps |

1.1.2.2.2.1 |

|

Revenue Stamps |

1.1.2.2.2.2 |

|

Coupons And Vouchers |

1.1.2.2.2.3 |

|

Other Liquid Valuables |

1.1.2.2.2.4 |

|

Cash And Financial Assets |

11 |

|

Cash and Cash Equivalents |

111 |

|

Cash |

1121 |

|

Currency On Hand |

11211 |

|

Petty Cash |

112111 |

|

Cash In Vault |

112112 |

|

Cash In Bank |

11212 |

|

Cash Equivalents |

1122 |

|

Deposits And Securities |

11221 |

|

Certificates Of Deposit |

112211 |

|

Commercial Paper |

112212 |

|

Credit And Debit Card Receivables |

112213 |

|

Money Market Funds |

112214 |

|

Other Highly liquid Investments and Securities |

112215 |

|

Other Cash Equivalents |

11222 |

|

Postage Stamps |

112221 |

|

Revenue Stamps |

112222 |

|

Coupons And Vouchers |

112223 |

|

Other Liquid Valuables |

112224 |

Since this limited sub-accounts to nine, he then added another digit, taking this to this.

|

Property, Plant And Equipment |

1.7 |

|

|

|

|

Machinery And Equipment |

1.7.3 |

|

Machinery |

1.7.3.1 |

|

Industrial Machinery |

1.7.3.1.1 |

|

Presses, Bending, Casting Machines |

1.7.3.1.1.1 |

|

Turning, Drilling, Milling, Grinding Machines |

1.7.3.1.1.2 |

|

Laser, Water-Jet, Photochemical, Ion Beam, Plasma Cutting Machines |

1.7.3.1.1.3 |

|

Broaching, Lapping, Honing Machines |

1.7.3.1.1.4 |

|

Turbines, Compressors, Pumps And Piping |

1.7.3.1.1.5 |

|

Ovens, Autoclaves, Heaters, Boilers |

1.7.3.1.1.6 |

|

Refrigerators, Air-Conditioners |

1.7.3.1.1.7 |

|

Washing, Cleaning, Sterilization Machines |

1.7.3.1.1.8 |

|

Cranes, Hoists, Convey Belts |

1.7.3.1.1.9 |

|

Industrial Robots |

1.7.3.1.1.10 |

|

3d Printers |

1.7.3.1.1.11 |

|

CNC, Cad/Cam |

1.7.3.1.1.12 |

|

Welders, Wrenches And Other Hand Held Tools And Machines |

1.7.3.1.1.13 |

|

Jigs, Dies, Molds, Fixtures |

1.7.3.1.1.14 |

|

Other Machines And Machine Tools |

1.7.3.1.1.15 |

|

Property, Plant And Equipment |

0107 |

|

|

|

|

Machinery And Equipment |

010703 |

|

Machinery |

01070301 |

|

Industrial Machinery |

0107030101 |

|

Presses, Bending, Casting Machines |

010703010101 |

|

Turning, Drilling, Milling, Grinding Machines |

010703010102 |

|

Laser, Water-Jet, Photochemical, Ion Beam, Plasma Cutting Machines |

010703010103 |

|

Broaching, Lapping, Honing Machines |

010703010104 |

|

Turbines, Compressors, Pumps And Piping |

010703010105 |

|

Ovens, Autoclaves, Heaters, Boilers |

010703010106 |

|

Refrigerators, Air-Conditioners |

010703010107 |

|

Washing, Cleaning, Sterilization Machines |

010703010108 |

|

Cranes, Hoists, Convey Belts |

010703010109 |

|

Industrial Robots |

010703010110 |

|

3d Printers |

010703010111 |

|

CNC, Cad/Cam |

010703010112 |

|

Welders, Wrenches And Other Hand Held Tools And Machines |

010703010113 |

|

Jigs, Dies, Molds, Fixtures |

010703010114 |

|

Other Machines And Machine Tools |

010703010115 |

While this did bump possible sub-accounts up to 99, it also threw human readability out the window.

In contrast, delimitation allows infinite expandability.

For example, one of our clients, a shipper with over 200 mid-sized and 600 full-sized trucks, wanted to recognize each truck at the COA level.

While not optimal, a delimited account number does make this approach possible.

Generally, it is better to limit accounts to a group level (i.e. Delivery Vehicles), devolving individual units of account (i.e. Vehicle #1, Vehicle #2, ...) to sub-classification level.

This approach would, for example, allow adjustments such as accumulated deprecation to be recognized at a group level, rather than individual asset level, simplifying the accounting process.

Obviously, no one size fits all structure exists.

A COA should always reflect the particular needs of the particular accounting entity.

Designing such bespoke account structures is one of the services we provide.

For more information on this and our other services, please visit our services page or contact us.

|

Property, Plant And Equipment |

1.7 |

|

|

|

|

Machinery And Equipment |

1.7.3 |

|

|

|

|

Equipment |

1.7.3.2 |

|

Transportation Equipment |

1.7.3.2.1 |

|

Vehicles |

1.7.3.2.1.1 |

|

Trucks |

1.7.3.2.1.1.1 |

|

Light Duty Trucks |

1.7.3.2.1.1.1.1 |

|

Light Duty Truck |

1.7.3.2.1.1.1.1 |

|

Light Duty Truck # 1 |

1.7.3.2.1.1.1.1.1 |

|

Light Duty Truck # 2 |

1.7.3.2.1.1.1.1.2 |

|

Light Duty Truck # 3 |

1.7.3.2.1.1.1.1.3 |

|

Light Duty Truck # 4 |

1.7.3.2.1.1.1.1.4 |

|

Light Duty Truck # 5 |

1.7.3.2.1.1.1.1.5 |

|

Light Duty Truck # 6 |

1.7.3.2.1.1.1.1.6 |

|

Light Duty Truck # 7 |

1.7.3.2.1.1.1.1.7 |

|

Light Duty Truck # 8 |

1.7.3.2.1.1.1.1.8 |

|

Light Duty Truck # 9 |

1.7.3.2.1.1.1.1.9 |

|

Light Duty Truck # 10 |

1.7.3.2.1.1.1.1.10 |

|

Light Duty Truck # 11 |

1.7.3.2.1.1.1.1.11 |

|

Light Duty Truck # 12 |

1.7.3.2.1.1.1.1.12 |

|

Light Duty Truck # 13 |

1.7.3.2.1.1.1.1.13 |

|

Light Duty Truck # 14 |

1.7.3.2.1.1.1.1.14 |

|

Light Duty Truck # 15 |

1.7.3.2.1.1.1.1.15 |

|

Light Duty Truck # etc. |

1.7.3.2.1.1.1.1.etc. |

|

Light Duty Truck # 245 |

1.7.3.2.1.1.1.1.245 |

|

Light Duty Truck # 246 |

1.7.3.2.1.1.1.1.246 |

|

Light Duty Truck # 247 |

1.7.3.2.1.1.1.1.247 |

|

Light Duty Truck # 248 |

1.7.3.2.1.1.1.1.248 |

|

Light Duty Truck # 249 |

1.7.3.2.1.1.1.1.249 |

|

Light Duty Truck # 250 |

1.7.3.2.1.1.1.1.250 |

|

Light Duty Truck # 251 |

1.7.3.2.1.1.1.1.251 |

|

Light Duty Truck # 252 |

1.7.3.2.1.1.1.1.252 |

|

Light Duty Truck # 253 |

1.7.3.2.1.1.1.1.253 |

|

Light Duty Truck # 254 |

1.7.3.2.1.1.1.1.254 |

|

Light Duty Truck # 255 |

1.7.3.2.1.1.1.1.255 |

|

Heavy Duty Trucks |

1.7.3.2.1.1.1.2 |

|

Heavy Duty Truck # 1 |

1.7.3.2.1.1.1.1.1 |

|

Heavy Duty Truck # 2 |

1.7.3.2.1.1.1.1.2 |

|

Heavy Duty Truck # 3 |

1.7.3.2.1.1.1.1.3 |

|

Heavy Duty Truck # 4 |

1.7.3.2.1.1.1.1.4 |

|

Heavy Duty Truck # 5 |

1.7.3.2.1.1.1.1.5 |

|

Heavy Duty Truck # 6 |

1.7.3.2.1.1.1.1.6 |

|

Heavy Duty Truck # 7 |

1.7.3.2.1.1.1.1.7 |

|

Heavy Duty Truck # 8 |

1.7.3.2.1.1.1.1.8 |

|

Heavy Duty Truck # 9 |

1.7.3.2.1.1.1.1.9 |

|

Heavy Duty Truck # 10 |

1.7.3.2.1.1.1.1.10 |

|

Heavy Duty Truck # etc. |

1.7.3.2.1.1.1.1.etc. |

|

Heavy Duty Truck # 650 |

1.7.3.2.1.1.1.1.650 |

|

Heavy Duty Truck # 651 |

1.7.3.2.1.1.1.1.651 |

|

Heavy Duty Truck # 652 |

1.7.3.2.1.1.1.1.652 |

|

Heavy Duty Truck # 653 |

1.7.3.2.1.1.1.1.653 |

|

Heavy Duty Truck # 654 |

1.7.3.2.1.1.1.1.654 |

|

Heavy Duty Truck # 655 |

1.7.3.2.1.1.1.1.655 |

|

Heavy Duty Truck # 656 |

1.7.3.2.1.1.1.1.656 |

|

Heavy Duty Truck # 657 |

1.7.3.2.1.1.1.1.657 |

|

Heavy Duty Truck # 658 |

1.7.3.2.1.1.1.1.658 |

|

Heavy Duty Truck # 659 |

1.7.3.2.1.1.1.1.659 |

Finally, after much gnashing of teeth, the IT department found is was possible to adjust the company’s accounting software to deal with periods.

As anyone who regularly deals with IT professionals eventually realizes, the seemingly impossible can become possible if management shows steely resolve and brings the full force of its decision making authority and budgeting power to bear.

Ours is not the first web site to number its COA using periods.

Canadian Statistics (link: statcan) has been using this format since at least 2002.

And no, we did not copy it from them. We found this COA on the internet while doing research on how different countries approach the issue of national charts of account.

Everyone lived happily ever after.

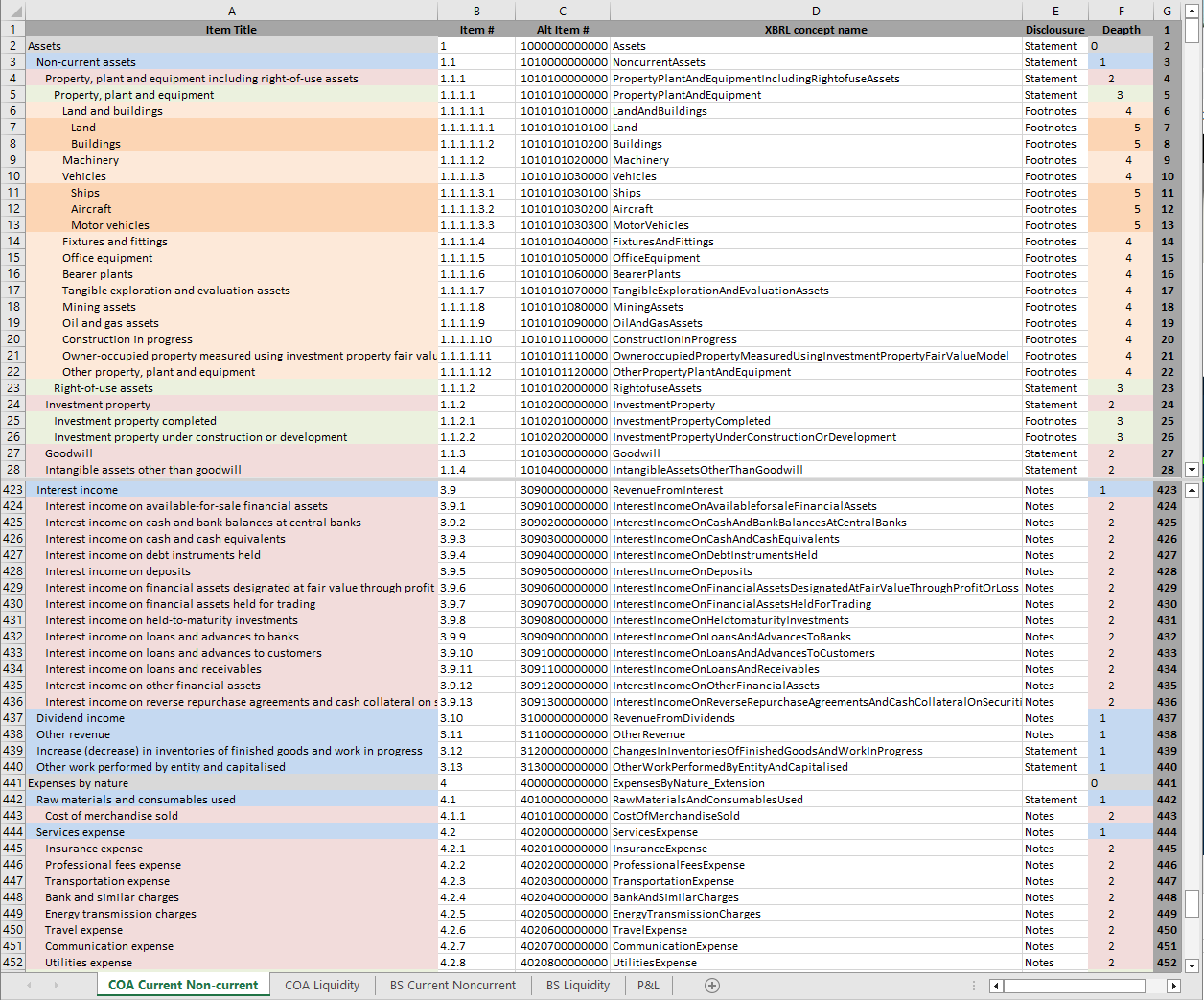

While not designed as a chart of accounts, the IASB published XBRL taxonomy can be adapted for this purpose.

This page includes an example of how this may be done.

This example is presented as is with no implicit or explicit guarantee.

Updated to reflect changes made in 2023.

Pro view .xlsx

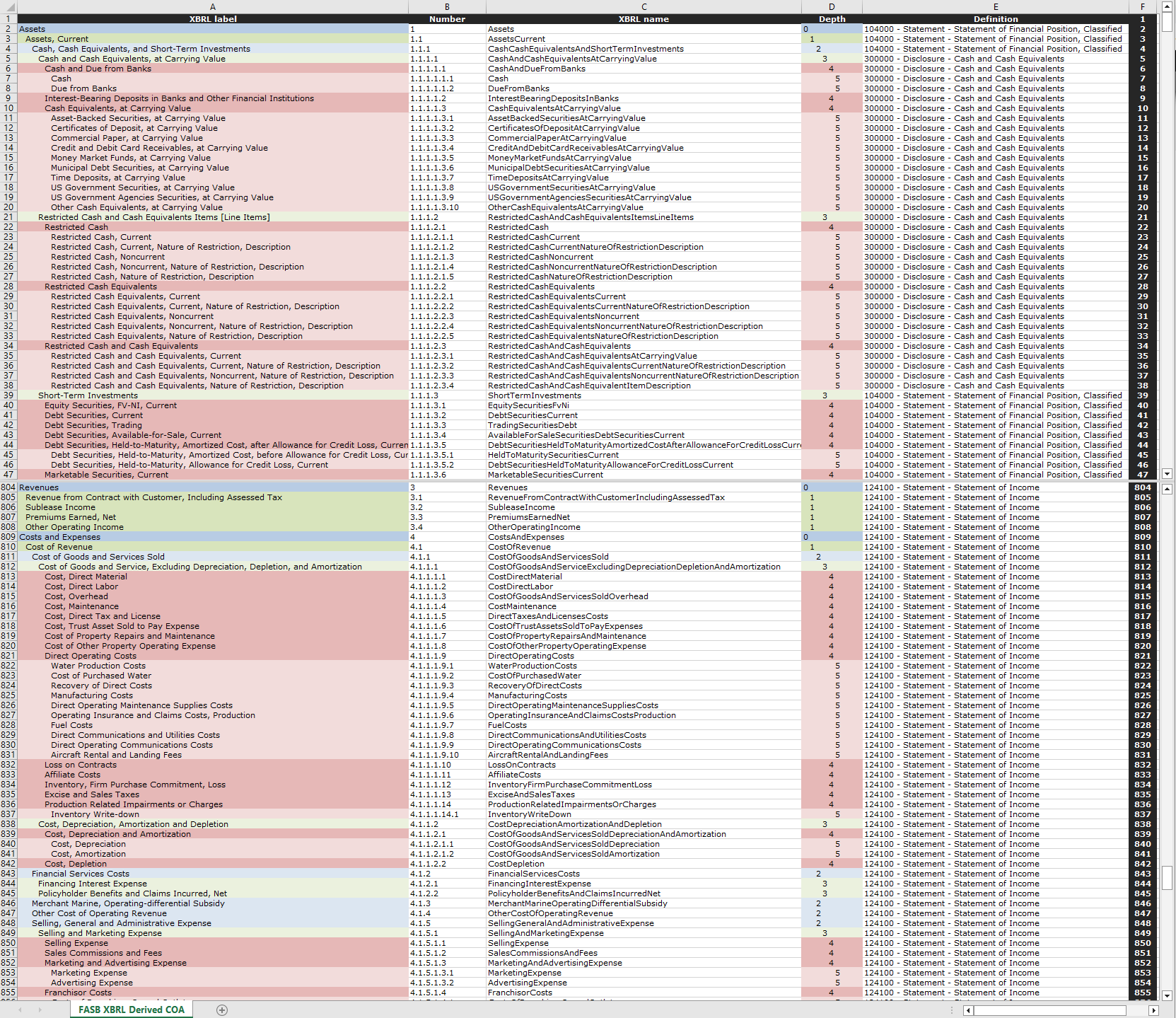

While not designed as a chart of accounts, the FASB published XBRL taxonomy can be adapted for this purpose.

or downloaded in Excel from this page: fasb.org (xlsx.zip)

This page includes an example of how this may be done.

Downloads of this chart in .xlsx are available in professional view.

Professional view costs €89.90 for one year.

Professional view does not renew automatically.

Get professional view or log in.

This example is presented as is with no implicit or explicit guarantee.

The FASB XBRL taxonomy includes various statement formats, this example is derived from the most general.

It reflects the 2024 FASB XBRL taxonomy.